According to the market analysis report “Conductive Polymer Capacitors, Global Markets, Technologies, and Opportunities: 2010-2015†released today, this report covers the use of polymer polymer dielectric materials such as polythiophene, polypyrrole, and polyaniline as cathodes. Capacitors, aluminum capacitors and carbon capacitors - changes in the market share of aluminum capacitors. Many of the aluminum capacitors are plug-in type, while other ceramic-based and tantalum-based capacitors are almost 100% surface mount. Similar to the situation in the past 20 years, radial lead aluminum electrolytic capacitors still accounted for the largest market share in terms of shipments and sales in 2010, but the share of surface mount aluminum capacitors is steadily and slowly growing - — In the past five years, the product has experienced explosive growth. The focus of future growth will be on Molded Conductive Polymer Aluminum Chip Capacitors. The recent focus on this area has focused on acquisitions and mergers that have occurred in the last three years. Molded Conductive Polymer Aluminum Chip Capacitors are expected to maintain a rapid growth rate until 2015, and in the future market for computers, game consoles, LAN networks and cable modems, this important new component will be price-oriented. Other capacitor technologies pose challenges.

According to the market analysis report “Conductive Polymer Capacitors, Global Markets, Technologies, and Opportunities: 2010-2015†released today, this report covers the use of polymer polymer dielectric materials such as polythiophene, polypyrrole, and polyaniline as cathodes. Capacitors, aluminum capacitors and carbon capacitors - changes in the market share of aluminum capacitors. Many of the aluminum capacitors are plug-in type, while other ceramic-based and tantalum-based capacitors are almost 100% surface mount. Similar to the situation in the past 20 years, radial lead aluminum electrolytic capacitors still accounted for the largest market share in terms of shipments and sales in 2010, but the share of surface mount aluminum capacitors is steadily and slowly growing - — In the past five years, the product has experienced explosive growth. The focus of future growth will be on Molded Conductive Polymer Aluminum Chip Capacitors. The recent focus on this area has focused on acquisitions and mergers that have occurred in the last three years. Molded Conductive Polymer Aluminum Chip Capacitors are expected to maintain a rapid growth rate until 2015, and in the future market for computers, game consoles, LAN networks and cable modems, this important new component will be price-oriented. Other capacitor technologies pose challenges. Molded Conductive Polymer Aluminum Chip Capacitors Industry Merger Frequently In 2009, the large-scale aluminum electrolytic capacitor and DC film maker Japan Nichicon Co., Ltd. purchased the Fujitsu Co., Ltd. media device (capacitor) business, which had already started to pass the price It has rapidly increased sales of its conductive polymer aluminum capacitors. In addition, in 2009, Murata Manufacturing Co., Ltd. of Japan purchased the capacitor business of Showa Denko Co., Ltd. This action is Murata's product for conductive polymer aluminum capacitors. This move has caused great interest in the industry because Murata's M&A operations have clearly deviated from their standard publicity: Through ceramic titanic acid materials, all capacitive solutions are satisfactory. As expected, Murata underscored in 2010 the development of a 100 to 1,000 microfarad capacitor that will dominate the future of digital electronics in this business. The biggest development in this narrow capacitor industry is the merger of Panasonic and Sanyo in 2009. The two companies have dominated the market for molded conductive aluminum polymer chip chips in the past decade. Panasonic has invested a large amount of Japanese yen to expand its molding polymer chip production line, and has thus established its leadership position in this market many years ago. On the other hand, Sanyo has become a major participant in the conductive polymer capacitor technology of aluminum and tantalum polymers. The company's original OS-CON low-ESR capacitor was a salt-structured complex electrolytic capacitor and ultimately helped the introduction of conductive polymer cathode systems in the market. Sanyo has been the leader in conductive polymer aluminum capacitor technology and offers the lowest possible ESR products. Sanyo's capacitive chip uses advanced technology for sophisticated processing, and its direct result is the advancement of the cathode gas diffusion process. The merger of the two companies created an unusual market situation because in 2010 they had a combined market share of more than 65% in the rapidly growing field of molded conductive aluminum capacitors. Although Panasonic and Sanyo are anxious to point out that the two companies have significant synergies in the field of secondary batteries, it is worth noting that in the company's introduction, they explained that both have significant advantages in the field of conductive polymer aluminum chip capacitors. Its market position and its technical strength will help the company move forward. They are right. However, these two huge component manufacturers jointly created a unique supply source for computer and game console manufacturers. And this is exactly what this type of customer does not like. Therefore, millions of market opportunities have already formed in the market of molded conductive polymer aluminum chip capacitors based on potential wealth transfer and sharing, which is already a considerable asset. When we analyze from the recent events in the $2 billion silicon chip capacitor market, many eyes are looking forward to molding conductive aluminum polymer capacitors as replacements for large-size silicon chip capacitors. A market segment has already gone from high capacity. The ceramic capacitor market is separated but cannot be separated from the supply chain.

Opportunities from the tantalum capacitor market: 2011-2015

In addition to the obvious opportunity brought by the future market share shift of conductive polymer aluminum capacitors, a bigger market opportunity lies in the replacement of the D and X case sizes of tantalum capacitor chips (replaced using the most primitive materials). In 2010, the unstable tantalum capacitor chip supply chain became a bottleneck between component suppliers and major end-market end users. The supply of germanium's raw materials (an element in the periodic table) has been reduced worldwide due to unstable mining (selectivity and government intervention), an outcome that has caused interruptions in the supply of capacitors. In August 2010, the delivery date of tantalum capacitors reached 40 weeks (a new high in the supply history of tantalum capacitors), and the current price of tantalum capacitors more than doubled in the past 12 months. In addition, it may also be the most important, that many major OEMs were affected by negative performances in 2010, so many international brand electronics companies have great interest in R&D alternative technologies. A similar precedent was the disruption of the same type of supply chain in 2000. As a result, high-volume ceramic chip capacitors were accepted in the high-volume market, and at the same time the small-volume market also strengthened the emerging molded-molded conductive polymer aluminum electrolytic capacitors. The market for chip capacitors and other capacitive technologies—such as tantalum capacitors, carbon capacitors, and hybrid capacitors (such as solar-induced PAS capacitors).

So when this happens again, it is expected that the company will again focus on tantalum capacitor replacement technology in 2011. However, for high-capacity multilayer ceramic capacitors, in practice, this technology has reached its limit when it is necessary to increase the capacitance value of more than 100 microfarad chips and maintain the life and integrity of the finished capacitor. Therefore, all eyes are on the molded conductive polymer aluminum chip capacitor, which is the most likely product to replace the tantalum capacitor business from 2011 to 2015. This has exacerbated the industry’s recent round of acquisitions, and its activities in other competitors’ markets, such as Kemet Electronics and Japan Carlit (PC capacitors).

Capacitance Technology Roadmap: Most suppliers of aluminum capacitor market in 2010-2015 put their technological direction on the reinforcement of molded-die-configured polymer cathode systems in order to compete with tantalum capacitor chips and were previously designed for vertical chip designs. Occupied areas. The major aluminum capacitor manufacturers will continue to develop advanced cathode systems and will explore capacitors for helium and carbon replacement technologies. We expect continuous investment in polymer technology and its supporting systems will create a creative development area in the capacitor industry in the next decade.

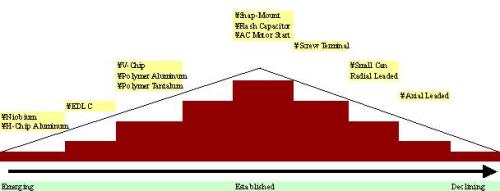

The aluminum capacitor technology roadmap has been developed to a node where new investment is focused on the development of aluminum solid polymer components and carbon and germanium media as alternative technologies. More sophisticated products such as snap-mounts, flash capacitors, and motor start aluminum capacitors have received limited investments but continue to serve smaller, value-added Capacitor market segmentation. Older products will receive less financial support for the development of new technologies, including standard radial lead aluminum capacitors and axial aluminum capacitors. For example, axially-leaded aluminum capacitors have received little attention in recent years, but they are still a traditional product and still have a market for defense and automotive applications. When used for the investment of all the major products listed in the above chart, when different levels of returns have been obtained in the past 20 years, the market has turned to aluminum solid polymer capacitor design, and the major suppliers in the industry are adjusting their positioning to Grasping huge market opportunities. Moreover, the introduction of conductive polymer aluminum technology in a number of key market segments with different uses, such as medical electronics, oil and gas exploration, will also bring value-added opportunities in specific application markets.

Solid conductor polymer capacitance will significantly increase by 2015. It is clear that solid polymer aluminum capacitors will gain significant growth in both technology and market because it can effectively replace competitive large-size germanium components and eliminate The need for potentially dangerous liquid electrolyte capacitors. Additional market opportunities stem from the replacement of vertical chip components, which makes the total available market for H-chips in 2010 more than $2 billion. This will address the shortcomings that the industry faces over time, such as the unstable helium supply chain, or the problem of liquid electrolyte capacitance in the circuit. As a result, this is a hot emerging market with huge market opportunities in the notebook, desktop and computer peripheral markets, gaming consoles, flat panel displays, DC/DC converters, digital cameras and global networking markets.

Challenges and Opportunities for Supply of Aluminum Raw Materials The use of aluminum cathode materials is a key to technological advancements in the construction of conductive polymer aluminum molded chip capacitors. This is a clear advantage compared with 钽 and 铌.

Aluminum is composed of bauxite, which is a resource-rich material. This means that raw metal prices will be lower under normal operating conditions. However, in 2010 we have noticed that aluminum price fluctuations and material shortages abound, especially for thin aluminum sheet materials. Although the supply of bauxite is not as stressful as that of helium, it is still affected because the demand for this metal will increase significantly in the climate that emphasizes green energy (light metal infrastructure requires less fuel ). In any case, a wider range of thin aluminum foil suppliers, as well as corrosion and molding companies, will make aluminum supply chains less risky than helium materials.

The main problem in molding the conductive polymer aluminum capacitor market is the limited capacitance value. In 2010, we estimate that it is only 20% of the capacitance of the tantalum capacitor. Compared with the tantalum capacitor product line, this problem is further exacerbated by the limited product portfolio. The number of available parts, the voltage, capacitance, and form factor far exceed the current capability of the tantalum capacitor. However, news from Japan shows that in the past the market has been dominated by companies interested in research and development of their complete tantalum capacitor production line; now owners from outside the company are interested in adopting this new technology to counter tantalum capacitor products. And it will not erode the existing product line, which means that the market will increase and become more competitive.

Conclusions Recent acquisitions and mergers and acquisitions mean that there is an increasing interest in the market for molded aluminum polymer capacitors with conductive polymers among the world's leading capacitor manufacturers. The diversification of demand for product raw materials—to avoid over-reliance on a certain product in the supply chain—is also an important opportunity that has prompted manufacturers to invest in this technology. Another opportunity is to hope for a technology that replaces tantalum capacitors - due to the instability of the tantalum supply chain and the limited capacity of ceramic technology in high volume applications above 100 microfarads. Coupled with aluminum's extensive material supply base (compared to helium and neodymium), many companies are hoping to use high-capacitance, small-volume stability components in digital electronics. Therefore, we conclude that by 2020, the demand for molded-plate conductive aluminum capacitors will exceed US$1 billion.